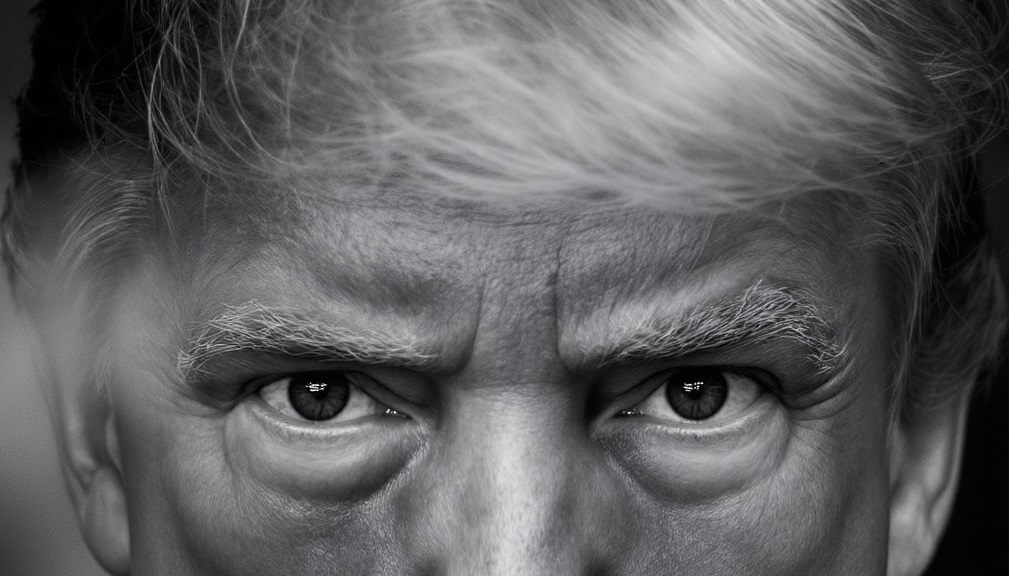

Trump’s Second-Term Tariffs: The 2025 Trade War Shaping America’s Economy

1. Introduction – The Return of Tariff Warfare

When Donald Trump reclaimed the White House in 2025, one of his first moves was to reignite his trademark protectionist strategy—this time, with unprecedented breadth. Under the banner of restoring “economic sovereignty,” Trump executed a sweeping global tariff campaign that sent shockwaves through markets and governments alike. Dubbed “Liberation Day,” his April executive orders marked a radical escalation: a 10% baseline tariff on nearly all imports, alongside country-specific “reciprocal” duties reaching up to 50%. It was a move that redefined U.S. trade policy, reactivated trade wars, and tested constitutional limits.

The shift was dramatic. In just weeks, tariffs on steel, aluminum, auto parts, and industrial goods across dozens of countries were enforced, prompting retaliation and pushing the U.S. tariff burden to levels not seen since the 1930s—driving headlines and outrage in global capitals.

2. Liberation Day — Triggering the Trade Earthquake

On April 2, 2025, standing beneath the Rose Garden’s white pillars, Trump declared “Liberation Day” and signed Executive Order 14257, invoking the International Emergency Economic Powers Act (IEEPA) to authorize sweeping import tariffs. The order instated a 10% baseline duty on virtually all imports beginning April 5, with country-specific “reciprocal” rates—up to 50%—scheduled for rollout on April 9 (Wikipedia).

Steel, aluminum, and auto parts became immediate targets. Countries like China, the EU, India, Vietnam, Japan, South Korea, and Taiwan faced steep, retaliatory-style tariffs that did not mirror their own trade barriers—a tactic labeled by many analysts as largely unilateral (Wikipedia).

Markets responded with alarm. Stock indices plunged, investor confidence wavered, and trade partners sounded the alarm. The White House framed the strategy as a bold return to economic nationalism—promising job growth, manufacturing resurgence, and a balance of trade shift—but the unprecedented scope and speed triggered global concern (Wikipedia, Financial Times).

3. The Legal Storm — V.O.S. Selections Ruling

Less than two months later, on May 28, 2025, the U.S. Court of International Trade delivered a stunning blow: in V.O.S. Selections, Inc. v. United States, the Liberation Day tariffs were struck down. Judges ruled that invoking IEEPA to justify sweeping tariffs over a trade deficit, failed to meet the statute’s bar for “unusual and extraordinary threat.” The court deemed the action an overreach of executive authority, violating both the nondelegation doctrine and the “major questions” doctrine. A permanent injunction halted enforcement, and Customs was ordered to stop collecting these duties—unless appeals reversed the decision (Wikipedia, Foreign Policy).

Trump’s administration appealed and secured a temporary stay, meaning the tariffs remained active during litigation (Wikipedia, Foreign Policy). The ruling crystallized a constitutional showdown: just how far can a president go on trade without congressional consent?

4. Global Response & Diplomatic Chessboard

The international fallout was swift.

- China responded with retaliatory tariffs, restricted exports of critical goods like rare-earth minerals and lodged complaints at the WTO, all while Trump threatened further hikes if Beijing didn‘t back down (Reuters, Financial Times).

- Canada and Mexico were hit with 25% tariffs. Canada retaliated with tariffs on $30 billion worth of U.S. goods—and plans for an additional $125 billion in coming weeks. A wave of boycott sentiment surged domestically in Canada, reducing reliance on U.S. exports (Wikipedia, Reddit).

- The EU, Japan, India, and others found themselves negotiating last-minute exemptions or deepening back-channel diplomacy to mitigate tariff damage. Yet many countries suffered steep levies tied to political or trade disputes, a move seen as weaponizing commerce (Financial Times, Wikipedia).

Amid these shifts, nations like Canada doubled down on free trade with regions beyond the U.S., such as the EU and Southeast Asia. Meanwhile, India’s relations with the U.S. hit a new low, with tariffs surging to 50% and prompting diplomatic resistance and delayed defense deals (Reddit, Wikipedia).

5. Inflation, Producer Prices & Consumer Resilience

Despite the tariff blitz, U.S. consumer prices remained surprisingly restrained—for now.

- June 2025 CPI rose 2.7% year-over-year; core inflation held near 3.1%, within market expectations. The Federal Reserve held rates steady but signaled a possible cut if consumer strength faltered (Business Insider, euronews, The Washington Post, The Economic Times).

- Still, the Producer Price Index (PPI) surged 0.9% in July—the steepest monthly jump in over three years—signaling rising costs upstream (The Times of India, BNN Bloomberg).

- Firms cushioned consumers by using inventories and deferring price hikes. Barclays estimated effective tariff rates at around 9%, not the headline 50%—buying time before sticker shock hit. But economists warn that as exemptions expire, effective rates could climb above 15%, pushing prices higher by year-end (The Daily Beast, New York Post, Barron’s).

The economic gamble was clear: political triumph through manufacturing revival, but with inflation looming if firms passed on higher costs.

6. The Political Bet

Domestically, Trump touted tariffs as patriotic victories—his base rallied around “America First” messaging. But cracks emerged in the armor.

- Producer pricing pressures and rising business costs hinted that consumer impact was near, potentially undermining cost-of-living narratives (The Daily Beast, AP News).

- Goldman Sachs analysis forecasted that consumer costs could rise dramatically—up to 67% of tariff burdens passed to households. Trump publicly dismissed these findings, attacking Goldman’s CEO in a social media post (Reuters, New York Post).

- Washington Post and FT commentators criticized the reliance on executive power without congressional backing, warning it sets a dangerous precedent and may weaken U.S. governance norms (The Washington Post, Financial Times).

Internationally, allies were increasingly anxious. A shifting, unilateral U.S. tarnished trust and market stability—and risked long-term damage to America’s credibility as a trade partner (Financial Times).

7. Outlook — What Lies Ahead

Trump’s second-term tariff campaign is far from settled.

- If the courts ultimately strike down “Liberation Day” tariffs, the administration may pivot to other legal tools like Section 301 or Section 232, or seek congressional approval for tariff policy (AP News, Barron’s, Wikipedia).

- With inflation warnings intensifying and political risks mounting, Trump may temper his rhetoric or pursue selective trade deals as holiday spending rises.

- On the global stage, countries are solidifying alternative partnerships—emerging trade blocs and alliances could diminish U.S. leverage long term (Financial Times, Reddit).

By year-end, the true cost—economic, constitutional, and geopolitical—of this protectionist push will become clearer.